The 2024 Government Work Report proposed that from this year on, it is planned to issue ultra long term special treasury bond for several consecutive years, which will be specifically used for the implementation of major national strategies and security capacity building in key areas. This year, it will issue 1 trillion yuan first.

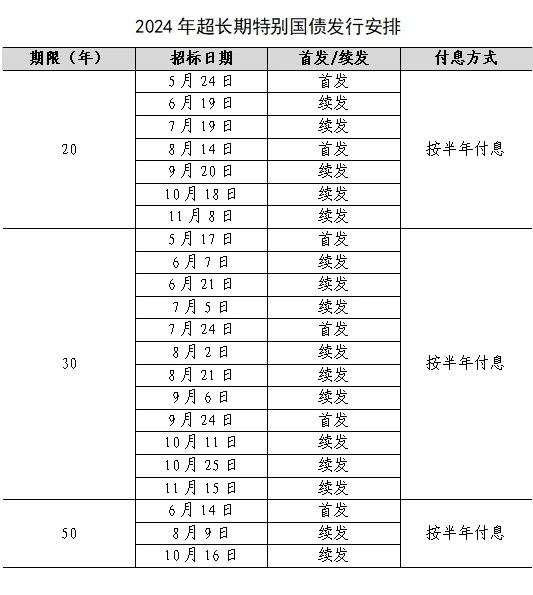

From the perspective of the "schedule", from the middle of May to the middle of November, 20, 30 and 50 year super long term special treasury bond will be issued in 7, 12 and 3 phases respectively, with the first issuing dates of May 24, May 17 and June 14 respectively.

What is super long term special treasury bond? How many issues have been released? Can individual investors purchase? Let's take a look togetherЎӘЎӘ

I. What is a super long term special treasury bond?

'Long term' refers to the duration. In the bond market, interest rate bonds with a maturity of more than 10 years are generally considered as "ultra long term bonds". Compared with ordinary treasury bond, ultra long term bonds can ease the pressure of short-term and medium-term debt repayment and trade time for space.

'Special' refers to the use of funds. Ultra long term special treasury bond is a treasury bond issued for specific purposes and has a clear purpose. The fund needs to be earmarked for specific purposes. According to this year's government work report, the super long term special treasury bond mentioned this time is to systematically solve the funding problem of some major projects in the process of building a strong country and national rejuvenation, and is dedicated to the implementation of major national strategies and security capacity building in key areas.

"Treasury bond" is a kind of government bond issued by the state to raise financial funds. It has the highest credit rating and is recognized as the safest investment tool, so it is popular among residents.

When will it be released? How many issues have been published already?

The issuance schedule has been announced: 1 trillion yuan will be issued this year, with terms of 20 years, 30 years, and 50 years respectively. The 30-year ultra long term special treasury bond were first issued on May 17 and renewed on June 7; The 20-year ultra long term special treasury bond were first issued on May 24; The 50 year ultra long term special treasury bond was launched on June 14.

3. What is the coupon rate?

(1) 20 years:

On May 24, the first 20-year super long term special treasury bond were fixed rate interest bearing bonds, with a total amount of 40 billion yuan, and the coupon rate was determined to be 2.49% after competitive bidding by the underwriting syndicate.

(2) 30 years:

On May 17, the bidding for 2024 ultra long term special treasury bond (Phase I) was completed. The current treasury bond is planned to issue 40 billion yuan, and the actual issued face value is 40 billion yuan. The term of the current treasury bond is 30 years, and the coupon rate determined through bidding is 2.57%.

On the morning of June 7, the Ministry of Finance issued the 2024 30-year super long term special treasury bond for the first time, totaling 45 billion yuan. The coupon rate of renewed treasury bond is the same as that of treasury bond issued in the same period, 2.57%.

(3) 50 years:

The total face value of the competitive bidding for treasury bond of this period is 35 billion yuan, and the coupon rate will be determined through the competitive bidding on June 14.

4. How can individual investors buy?

In terms of issuance mode, this year's ultra long term special treasury bond are all issued in a market-oriented manner, all of which are open to bookkept treasury bond underwriting syndicates. Individual investors cannot directly participate in bidding and purchasing through the issuance system, but can open accounts to purchase and trade on the exchange market or commercial bank counter market.

Warm reminder:

Ultra long term special treasury bond belong to bookkeeping treasury bond. Such treasury bond can be listed and traded with high liquidity. The trading price will fluctuate according to market conditions. After investors buy, they may gain trading profits due to price increases or face loss risks due to price decreases. Therefore, individual investors who aim to trade without holding until maturity should have certain investment experience and risk-taking ability. Individual investors need to pay attention to trading risks and invest rationally.