Recently, some criminals have impersonated securities companies and practitioners, using the pretext of "securities subscription" to deceive students from educational and training institutions who have a demand for tuition refunds, resulting in varying amounts of losses. What are the fraudulent methods of the new scam? How to remain vigilant and avoid being deceived? Today, let's learn together.

1. Case Review

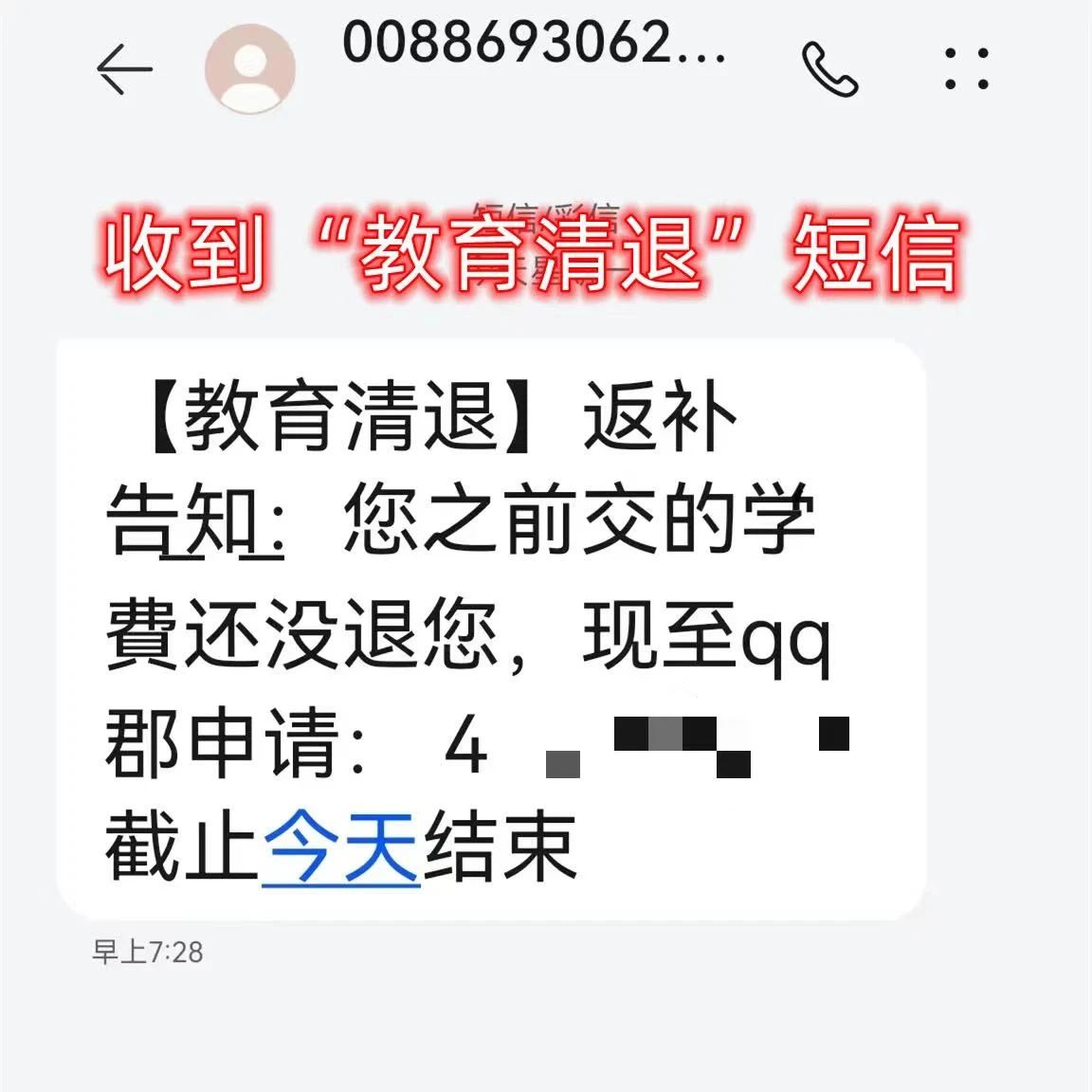

In early January of this year, Ms. Huang (pseudonym) from Zhongshan received a text message stating that she could refund her tuition fees, so she joined the QQ group in the message.

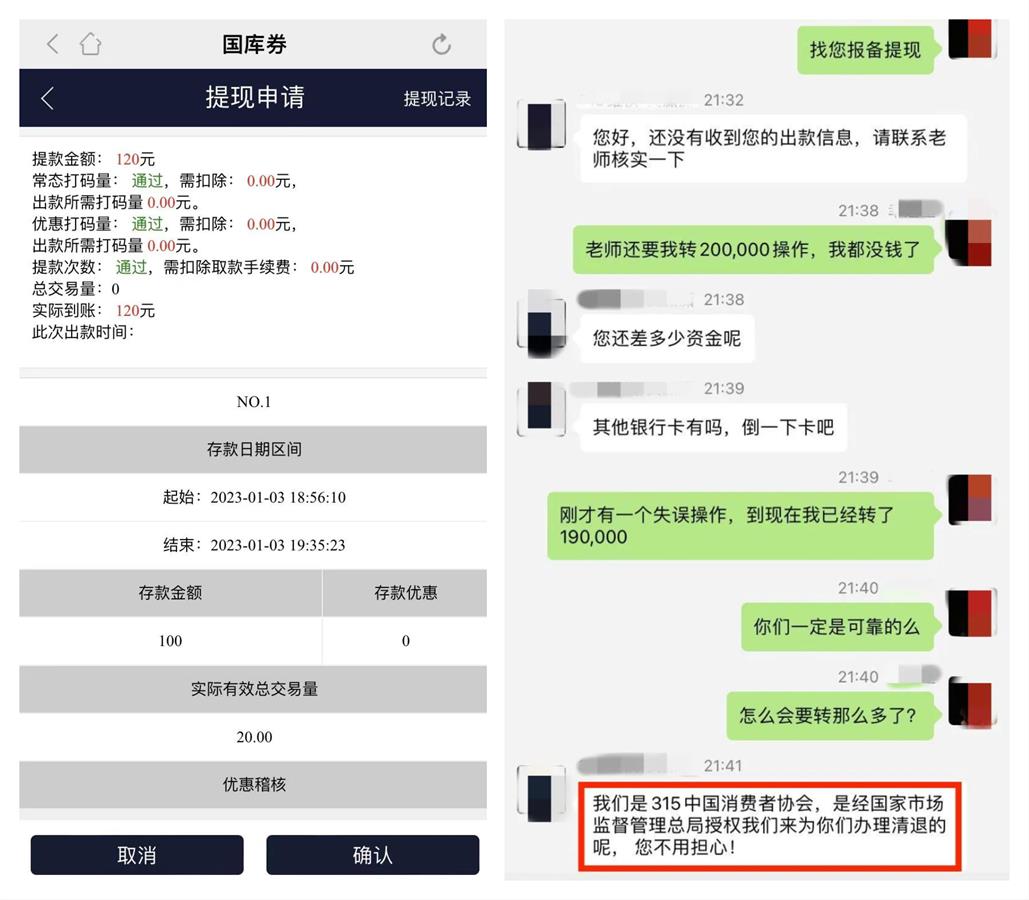

After joining the group, Ms. Huang followed the prompts and clicked on the link to download an app called "3.15 Rights Protection". The other party claimed that the app was the official platform for clearing tuition fees in China, and the Consumer Association acted as a "third party" to assist in clearing tuition fees by uniformly refunding them through "purchasing treasury bonds for appreciation".

When purchasing "treasury bonds", the platform will redeem 20% of the principal, which means purchasing 1000 yuan can redeem 1200 yuan, and promises to refund both principal and interest.

Ms. Huang tried to transfer 100 yuan and indeed received 120 yuan, which made her believe even more in the so-called 'official refund method'. Subsequently, encouraged by the other party, Ms. Huang began to increase her investment in transferring funds, totaling 260000 yuan. When Ms. Huang received a call from the Anti Fraud Center 96110, she realized that she had been deceived and quickly reported to the police.

II. Analysis of Fraudulent Techniques

1�� Identify target audience

Scammers often obtain user information of training institutions through illegal means, falsely claiming to refund tuition fees to victims through phone calls and text messages, and inducing victims to add friends or join QQ groups. Scammers also disguise themselves as refund commissioners, posting forged debt transfer agreements and course payment records to deceive victims into trusting them.

2�� Click on the link to download the app

After deceiving the victim's trust, the scammer falsely claimed that refunds must be completed within a designated app, guiding them to click on unfamiliar website links to download the fake app and obtain important information such as bank cards and verification codes.

3�� Micro income induction

Victims can receive principal and rebates by investing funds according to guidelines, and driven by micro returns, they will continuously increase their investment. At this point, the scammer no longer returns the funds and continuously induces the transfer for reasons such as one-time return after operation, operational errors, account freezing, and payment of unfrozen funds.

III. Fraud Prevention Reminder

1. When receiving a phone call or message from a staff member claiming to be a "training institution" requesting a refund, be vigilant and verify through official channels.

2. The formal refund process often directly returns the money to the personal account, and anyone who needs to pay additional fees, request transfers, or guide investment rebates is considered fraudulent.

3. Legal securities operating institutions and their employees' information can be accessed through the "Information Disclosure" section on the website of the China Securities Regulatory Commission or the website of the China Securities Association (website: https://www.sac.net.cn/xxgs ��Search.

4. If you receive unfamiliar phone calls and text messages starting with "00" or "+", be sure to be vigilant. These are mostly fraudulent phone calls from overseas, do not believe them.

5. Do not transfer or remit money easily, and do not pay any deposit or security deposit at will.

6. If you are accidentally deceived, please keep relevant evidence such as chat records, transfer and remittance records, and call 110 to report to the police in a timely manner.

Comprehensive content from China Securities Regulatory Commission, Zhongshan Anti Fraud Center, and Minjiao New Observation